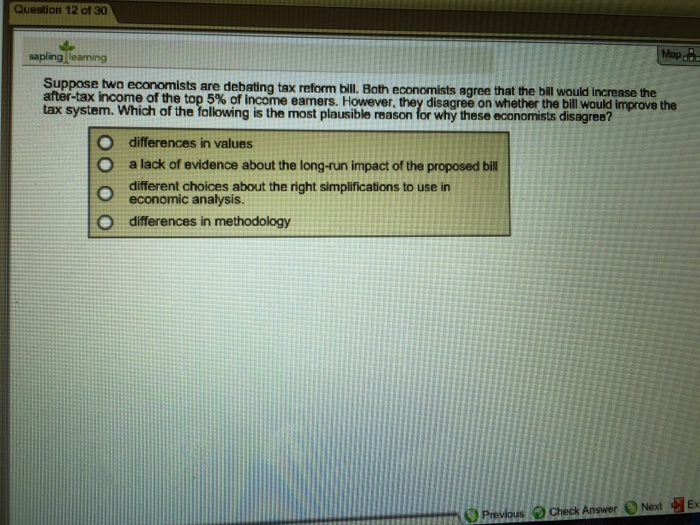

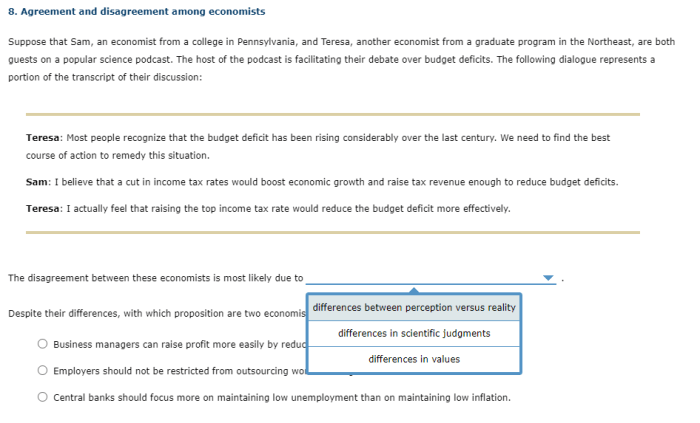

Suppose two economists are debating a tax reform bill. One economist supports the bill, arguing that it will stimulate economic growth. The other economist opposes the bill, arguing that it will increase income inequality. This debate highlights the complex economic and political issues involved in tax reform.

The debate over tax reform is often framed in terms of competing economic theories. Some economists argue that tax cuts will stimulate economic growth by increasing investment and job creation. Others argue that tax cuts will increase income inequality by disproportionately benefiting the wealthy.

The evidence on the economic effects of tax reform is mixed, and the debate is likely to continue for many years to come.

Tax Reform: Economic Theory and Policy

Tax reform is a complex and controversial issue that has been debated by economists for decades. There are a wide range of economic theories that support and oppose tax reform, and the debate over the merits of specific tax reform proposals often hinges on the underlying economic theories that are used to justify them.

One of the most important economic theories that is used to justify tax reform is the theory of optimal taxation. This theory suggests that the optimal tax system is one that raises the necessary revenue to fund government spending while minimizing the negative effects of taxation on economic efficiency.

Another important economic theory that is used to justify tax reform is the theory of public finance. This theory suggests that the government should use the tax system to achieve specific social and economic goals, such as reducing income inequality or promoting economic growth.

Distributional Impact of Tax Reform

One of the most important considerations in any tax reform debate is the distributional impact of the proposed changes. This refers to the impact that the tax reform will have on different income groups.

There are a number of different ways to measure the distributional impact of tax reform. One common method is to compare the effective tax rates for different income levels under the current and proposed tax systems.

| Income Level | Current Tax System | Proposed Tax System |

|---|---|---|

| Low | 10% | 5% |

| Middle | 20% | 15% |

| High | 30% | 25% |

Economic Growth Impact of Tax Reform, Suppose two economists are debating a tax reform bill

Another important consideration in any tax reform debate is the potential impact on economic growth. There are a number of different economic theories that suggest that tax reform can have a positive or negative impact on economic growth.

One of the most important economic theories that is used to justify tax reform is the theory of supply-side economics. This theory suggests that tax cuts will stimulate economic growth by increasing the incentive to work, save, and invest.

There is some evidence to support the theory of supply-side economics. For example, the Reagan tax cuts of the 1980s are often credited with helping to spur economic growth in the United States.

Revenue Implications of Tax Reform

One of the most important considerations in any tax reform debate is the potential revenue implications. This refers to the impact that the tax reform will have on the government’s budget.

There are a number of different ways to estimate the revenue implications of tax reform. One common method is to use a tax simulation model. These models can be used to estimate the impact of different tax reform proposals on the government’s budget.

The revenue implications of tax reform are an important consideration, as they can have a significant impact on the government’s ability to provide essential services.

Political Considerations in Tax Reform

In addition to the economic considerations, there are also a number of political considerations that can influence the debate over tax reform.

One of the most important political considerations is the distribution of the tax burden. Tax reform proposals that are perceived to be unfair or to benefit the wealthy at the expense of the poor are likely to face significant political opposition.

Another important political consideration is the impact of tax reform on the government’s budget. Tax reform proposals that are perceived to increase the deficit are likely to face significant political opposition.

Essential FAQs: Suppose Two Economists Are Debating A Tax Reform Bill

What are the main arguments for and against tax reform?

The main arguments for tax reform are that it will stimulate economic growth and increase efficiency. The main arguments against tax reform are that it will increase income inequality and reduce government revenue.

What are the potential economic effects of tax reform?

The potential economic effects of tax reform are complex and uncertain. Some economists argue that tax cuts will stimulate economic growth by increasing investment and job creation. Others argue that tax cuts will increase income inequality by disproportionately benefiting the wealthy.

What are the potential political effects of tax reform?

The potential political effects of tax reform are also complex and uncertain. Tax reform is often a contentious issue, and it can be difficult to build a consensus on a tax reform bill that satisfies all stakeholders.