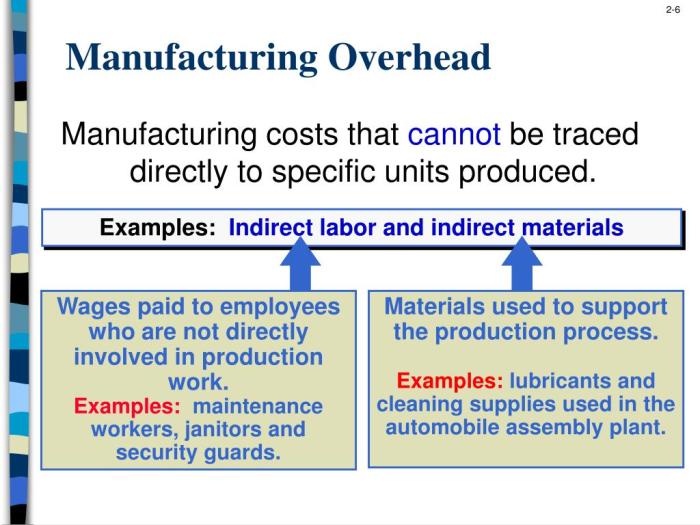

Indirect materials and indirect labor are classified as blank______. – Indirect materials and indirect labor are classified as overhead costs, meaning they are not directly tied to the production of a specific unit of output. These costs are essential for the overall operation of a business but cannot be easily assigned to a particular product or service.

Understanding the classification of indirect materials and indirect labor is crucial for accurate financial reporting and effective cost management. This article delves into the definition, classification, and impact of these costs on financial statements, providing insights for better decision-making.

Definition of Indirect Materials and Indirect Labor

Indirect materials and indirect labor are types of expenses that are not directly related to the production of goods or services. They are classified as overhead costs because they are not specifically identifiable with a particular unit of production.

Examples of indirect materials include:

- Factory supplies, such as oil, rags, and cleaning supplies

- Indirect labor, such as the wages of factory supervisors and maintenance workers

Classification of Indirect Materials and Indirect Labor

Indirect materials and indirect labor are classified as overhead costs because they are not directly related to the production of goods or services. This means that they are not included in the cost of goods sold but are instead expensed in the period in which they are incurred.

The rationale behind this classification is that indirect materials and indirect labor are necessary for the production of goods or services but are not directly attributable to a specific unit of production. For example, factory supplies are used to maintain the factory floor and equipment, but they are not directly used in the production of any particular product.

Impact on Financial Statements

Indirect materials and indirect labor are presented on the income statement as separate line items below direct materials and direct labor. They are included in the calculation of gross profit and net income.

The inclusion of indirect materials and indirect labor in the calculation of gross profit and net income means that these costs have a direct impact on the profitability of a company. By reducing indirect materials and indirect labor costs, a company can improve its profitability.

Management of Indirect Materials and Indirect Labor Costs

There are a number of strategies that companies can use to manage indirect materials and indirect labor costs. These strategies include:

- Budgeting: Companies can create budgets for indirect materials and indirect labor costs to help control spending.

- Purchasing: Companies can negotiate with suppliers to get the best possible prices on indirect materials.

- Inventory management: Companies can implement inventory management systems to help control the amount of indirect materials on hand.

- Labor management: Companies can implement labor management systems to help control the amount of indirect labor used.

Comparison with Direct Materials and Direct Labor

Indirect materials and indirect labor are different from direct materials and direct labor in that they are not directly related to the production of goods or services. Direct materials are the materials that are used to make a product, and direct labor is the labor that is used to produce a product.

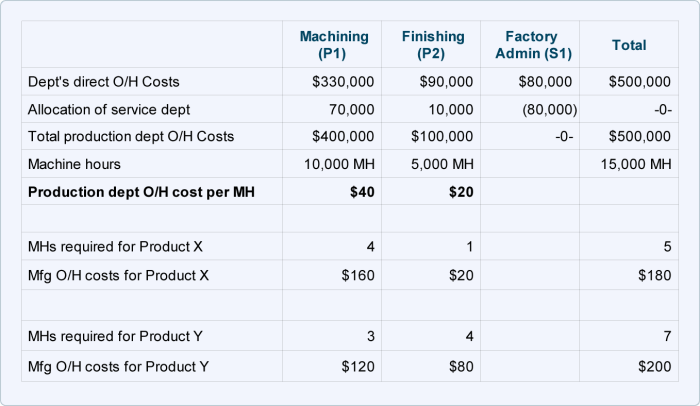

The following table summarizes the key differences between indirect materials and indirect labor and direct materials and direct labor:

| Expense Type | Directly Related to Production | Included in Cost of Goods Sold |

|---|---|---|

| Direct materials | Yes | Yes |

| Direct labor | Yes | Yes |

| Indirect materials | No | No |

| Indirect labor | No | No |

FAQ Section: Indirect Materials And Indirect Labor Are Classified As Blank______.

What is the difference between indirect materials and direct materials?

Indirect materials are used in the production process but cannot be directly traced to a specific unit of output, while direct materials are directly incorporated into the finished product.

How are indirect labor costs typically allocated?

Indirect labor costs are often allocated based on a predetermined overhead rate, which considers factors such as labor hours or machine usage.

What is the impact of indirect costs on gross profit and net income?

Indirect costs reduce gross profit by increasing the cost of goods sold and can impact net income depending on the level of these costs relative to revenue.